Example analog stock for company " CO. "

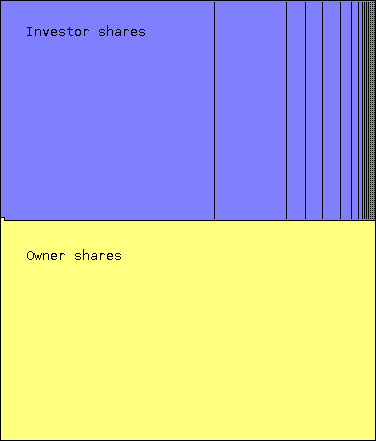

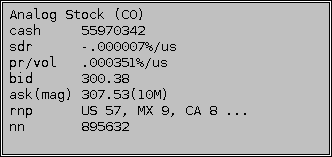

With an analog stock, a percentage of the entire stock is always available to buy. By adding value to all shares at once enough to surpass the value of the old set of larger portion's with the value of the new same set of smaller portions while creating room for the added shares. Because of constant availability, stock may be bought with software plus bank third party. An analog bulk order by price amount would be used, quantity amount then becoming determined. Selling stock requires an analog bulk sale brokerage mechanism with broker third party and bank third party, and is completed only when a buyer is found for all of given percentile amount of stock sold vs. the time of the order. These bulk orders could be interruptible at any time while they are running. The buying and selling would use queuing allowing multiple transactions to occur simultaneously. Transaction logs for any given period would always be available digitally. Stock would be bought in parcels of single denomination's of currency's worth. The currency thereafter appearing as part of the company's cash on hand deposits could be reflected in synchronization data summed in with company withdrawals and deposits upon this figure. Here it is shown in the analog stock program's virtual terminal below left as cash, while also reflected in the stock price vs. share magnitude ask(mag). Share magnitude divides the investor shares into logical and conventionally affordable pieces, and may change from time to time. In this example case is 10,000,000 where the formula for deriving it is:

s / (10000000 * .50000001) = 307.529987699 per investor share

s / (10000000 * .49999999) = 307.530000001 per owner share

where s (1,537,649,969.25) is the value of the sum of all CO. stock, and the owner shares are trapped. For every transaction in this transaction replete method of company stock, the smallest fraction of the rounding down of the best representation of redistribution would leave some cash extra in the till. This could go to pay for upkeep of the exchange. Half plus a bit of the stock would always be owned by the company owner and acceptable to price fluctuation. The owner may choose to save on insurance and keep all of the currency representing half plus a bit of the stock in cash on hand, thus having a buyout mechanism in the correct denomination if there were ever any issue, meanwhile padding the value of the stock and allowing the company an allowance from the interest.

Registered national percentages in the transaction data shown in the analog stock virtual terminal program as rpn, would show the nation of stock owner's by percentage if they filled out that value in their account info. The nn value would indicate the amount of distributed nodes connected and synchronized with exchange data. Any node might also provide service for online payment separately. Since the transaction of buying or selling one unit of denomination's worth of stock must be faster than the synchronizing of the data, any such service could provide a level playing field by providing overdraft for one unit of denomination.

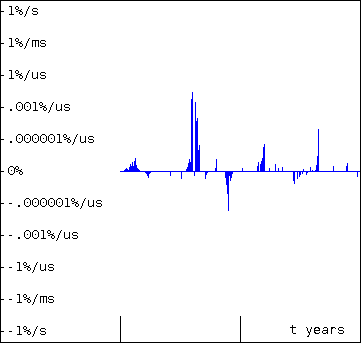

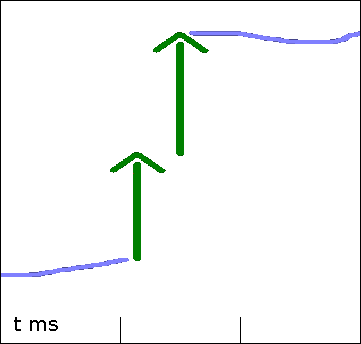

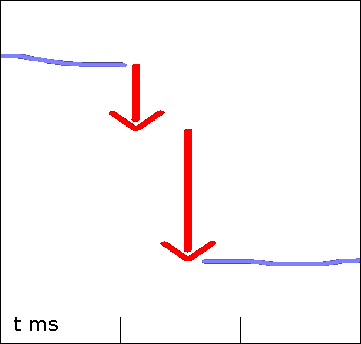

This histogram shows what the single denominator rate shown in the terminal info diagram as sdr might look like concurrently. Since cash on hand is listed, investors get a signal when stock buyers are pumping currency in, or when the company is spending, or for other finance events of the day. These could then be researched keeping investors in touch with the companies efforts. The stock price per volume would have a similar histogram, showing how demand is effecting price.

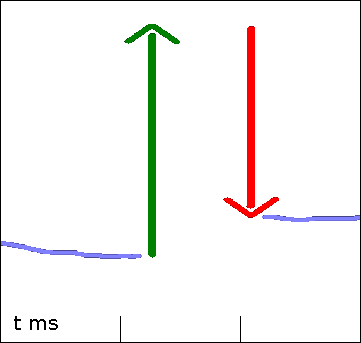

A bulk buy and sell arriving at the same time is shown. If you are buying while someone is selling your cost will go down while their receipts go up.

Buying while others buy increases price more-so at each purchase yet the earliest bought stock will then gain value more-so as the bulk orders complete.

When selling while others are selling, the amount received for stock goes down more-so, so one might stop selling in this case if the broker allowed this.

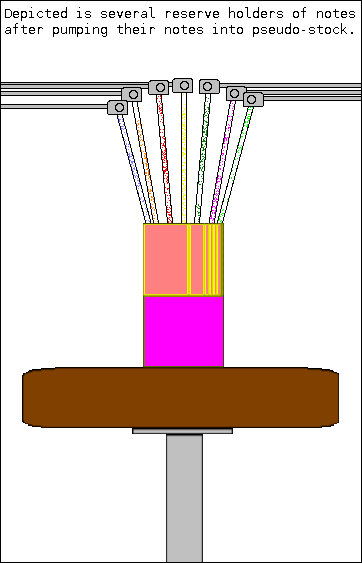

One neat feature of this type of stock is the possibility for multiple reserves of cash to be simultaneously pumped into stock as a synchronous transaction for a limited list of accounts. This would be a special type of pseudo-stock, only available for this feature. The difference would be the allowing of stock destruction and payout from possibly an insured reserve of call money, or a stasis reserve. The pseudo-stock would appreciate or depreciate based on market conditions were there call money reserved, while the value of the notes therein would then re-evaluate naturally with scarcity coming in once the greater part of all notes were represented.