Example fictional publication

Collections of investment grade lease tokens could be repackaged where legal as a single average spanning index set of a more so universal type of token as an Average Lease Token Decimeter Year (ALTDMY) token, or likewise where fractional measuring is prevalent perhaps formulated as Average Lease Token Hundredth Yard Year (ALTHYY), or perhaps most intuitive and best might be Average Foot Month (AFM).

Example fictional publication |

|

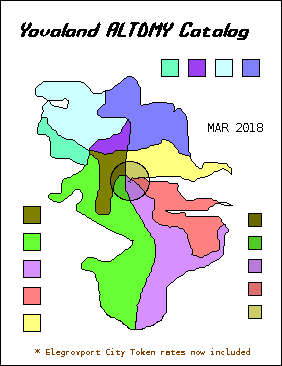

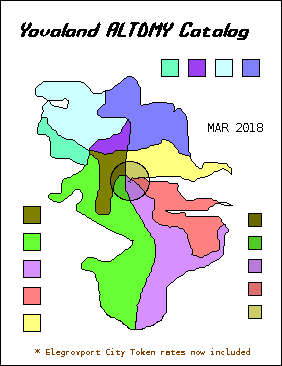

Indexes could overlap geographically. The cover of this

imaginary glossy lease token catalog on the web shows this.

Within would be lease space promotion efforts of building owners

desiring to pitch their investment grade tokens where those

were found at the base of one of the included ALTDMY, ALTHYY or AFM

indexes. The publication of DMY/HYY/AFM exchange rates gives ballpark

figures, yet the rates would likely move slowly from month

to month depending on premium values of the basis tokens

tending to average as a steady upward incline ideally.

To set up an index a basis set of tokens is gathered together

to represent average valued favored fundamentals investment

grade tokens in a geographic area. Each token in the basis

set is then divided by it's own lease length then divided by

100 all these then summing together to give n. The market value

of the sum of the entire basis set is then divided by n giving x.

The repackaged set is then issued as a fully backed second derivative

set of n DMY/HYY/AFM tokens market evaluating as x units of currency

per, plus their own demand premium.

DMY/HYY/AFM tokens are always fully backed and may increase in

quantity as the basis set grows, the maintainers taking a gain

when they trade tokens wisely while retaining the same or greater

total for sum of each lease tile in the basis set * it's lease length.

If this total is increased, the DMY/HYY/AFM tokens represented then

increase in number.

To avoid fears of counterfit, all DMY/HYY/AFM tokens on an index

must be listed together with no extra ones, each of these assigned

to a private account number. The literature should document basis

tokens as to area * lease length and value for each un-named set

(for three months perhaps) thereafter naming the supplier as

well.

A money back guarantee could serve to insure account holders

against the occurrence of damage to sets of basis tokens that

were poor investments by index maintainers. Those could be

discounted to be picked up by leaseholders leveraging any

damaged basis tokens below the floor rate. Meanwhile more

basis tokens would need to be acquired to cover the difference

in DMY/HYY/AFM totals.

If the basis set somehow shrinks, or set therein becomes damaged,

be sure to have extra backing or a significant reserve of the issue,

as the bottom price has the potential to sink below the floor value

equivalent of the basis tokens. With a diverse collection of basis

token set's however, such a bottom price is extremely unlikely.

In fact insuring the DMY/HYY/AFM issue for floor value equivalent, along

with a significant index reserve on the books, would be an excellent idea

to calm potential fears of basis token over valuation.

Repackaged lease tokens in this example trade as

ALTDMY Elegrovport City tokens electronically at the current

maintainer electronically published rate.

this page last edited 26Apr16