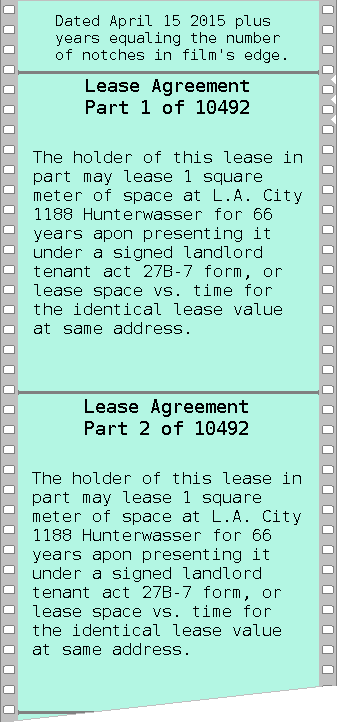

Hypothetical lease agreement (film)

Lease tile vs. derivative "Token Tile"

Film canister

A conceptual lease tile, derived from the would be presentation value of a digital token for a tile, could represent for example part 1 of hypothetical lease shown, thus a square meter of example leased space. Further, lease tiles representing further parts of the lease for the same address up to and including lease tile 10492 could also become derived. These lease tile's thus represented could be sold in bulk as rights to the lease agreement on film minus the contract value, to debit providers for inclusion on their server's and use with their card. The contract might also be traded for a part quantity share of their token representation. For the derived tokens out of this hypothetical lease to be used as a lease payment, a lease must be available or occupied (by the token owner) at the address, and the 27B-7 form must be signed by the building owner.

The top two parts of the lease agreement as shown in the example, with the rest of the film, could be transfered to video by an auditor for the debit provider, who then seals the lease in a film canister. Yearly a notch may optionally be added to such a film while an annual audit takes place the cannister thereby resealed. The debit provider's auditing representative would keep a contract with the lease issuer (building owner) insuring that the tiles stayed correctly rated, thus any rate change information would be forwarded to the auditor's office, then to the token tile server maintainers on the time basis used. All contract's and liability agreements pertinent to the token tiles (lease rights derivatives) would be clearly represented as documents accompanying the sealed cannister.

The actual token representation "Token Tile" itself once upon the debit companies server will hold all accompanying information about itself and be digitally signed and accessible as a singular entity for purchase. These could be stored on a debit card in savings for investment purpose and transfered to checking with online or debit provider software for regular use at point of sale. One way to save on taxes would be to have clients agree to always automatically loan purchased tokens in the checking account to the debit provider to be held on call at zero interest. The token tile's owner could then freely accept cash value from the server instead of the token represented, so that vendors would see no difference from a cash card.

- The variety of tokens one may hold in savings and conditionally checking might be extended depending on the debit provider's willingness to hold or own tokens from other companies and local legislation. It may hold likely that most companies will only want to deal in their own token's anyway, and that a third party exchange would be more-so apt to trading an index of many provider's tokens.

- Some of the tokens of any unique building's set would be set aside to represent fragmented ownership needed to denominate smaller amounts used in buying with and selling of token tiles, fragments being sorted by the software on the server.

- Transfer of the contract rights to such lease agreement requires the buy-out or transfer of all of the tokens as described on the accompanying page, and a new provider.